Filing taxes can be a daunting task, especially when it comes to submitting the right forms on time. One such form is Form 15G, which is primarily used by taxpayers to prevent TDS (Tax Deducted at Source) on interest income if their total income is below the taxable limit. For many, having a Word version of the form makes the process much simpler because it allows for easy editing, saving, and printing. In this guide, we will walk you through how to download Form 15G in Word format, fill it properly, and submit it without any hassle.

What is Form 15G?

Form 15G is a self-declaration form used by individuals below 60 years of age and Hindu Undivided Families (HUFs) to ensure that no TDS is deducted on their interest income. It is particularly useful for those who earn interest from fixed deposits, recurring deposits, or other similar sources.

Key points about Form 15G:

-

Applicable to individuals below 60 years and HUFs.

-

Helps avoid TDS on interest income if taxable income is below the exemption limit.

-

Must be submitted at the beginning of the financial year or before the bank/company deducts TDS.

Benefits of Using Form 15G

Filing Form 15G comes with multiple benefits:

-

Avoid TDS Deduction: The primary advantage is that it ensures your interest income is not subjected to TDS.

-

Easy to File: With a Word format, filling out the form is straightforward, allowing you to edit and save your details easily.

-

Saves Time: Word format forms can be filled offline and printed instantly.

-

Error Reduction: Pre-filling the form reduces mistakes compared to filling it manually on paper.

How to Download Form 15G in Word Format

Downloading Form 15G in Word format is quite simple if you know the right sources. Follow these steps to get the editable form:

Step 1: Visit the Official Websites

You can start by visiting official websites such as the Income Tax Department or major banks that provide Form 15G for their customers. Many banks provide both PDF and Word versions of the form.

Step 2: Search for the Form

Once on the website, navigate to the Forms section. Look specifically for “Form 15G Word Version” or “Download Form 15G in Word Format.”

Step 3: Click on the Download Link

After locating the form, click the download link. Ensure you save it in an easily accessible folder on your computer so you can fill it later.

Step 4: Open and Edit the Form

Open the Word file in Microsoft Word or any compatible editor. Fill in your personal details, income details, and other necessary information.

Step 5: Save and Print

After completing the form, save it and take a printout for submission. Ensure you sign the form before submitting it to the concerned bank or institution.

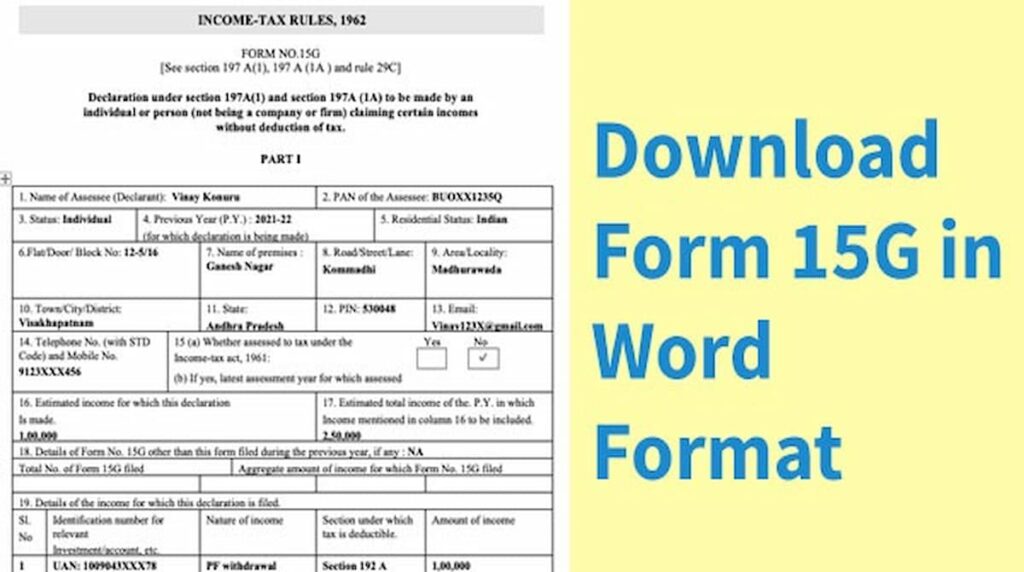

Key Sections in Form 15G

When filling out Form 15G, it is important to understand its sections to avoid mistakes.

1. Personal Information

This includes your name, PAN number, date of birth, and contact details. Ensure that the PAN number is correct, as incorrect information can lead to rejection.

2. Financial Details

Here, you provide details of interest income, such as bank name, branch, and account number. You also need to mention the total estimated income for the year.

3. Declaration

This section includes a declaration that your total income is below the taxable limit and that the information provided is accurate.

4. Signature

Finally, sign the form before submission. Unsigned forms are not considered valid.

Tips for Filing Form 15G

Filing Form 15G is simple, but following a few tips can ensure accuracy:

-

Always double-check your PAN number and bank account details.

-

Ensure the financial year mentioned in the form is correct.

-

Keep a copy of the filled form for your records.

-

Submit the form before TDS is deducted to avoid complications.

-

If you have multiple bank accounts, submit separate forms for each account.

Common Mistakes to Avoid

Even though Form 15G is easy to fill, taxpayers often make errors that can lead to rejection. Common mistakes include:

-

Submitting without a signature

-

Incorrect PAN or bank account details

-

Filing after the interest has already been credited

-

Not updating the financial year correctly

By using a Word format and carefully reviewing your entries, you can minimize these errors.

Conclusion

Knowing how to download Form 15G in Word format can save time and simplify the process of avoiding TDS on your interest income. With the editable Word version, you can easily fill in your details, print the form, and submit it without any hassle. Remember to check all information carefully, sign the form, and submit it on time to ensure smooth processing. Filing Form 15G correctly helps you manage your finances efficiently and avoid unnecessary deductions.

FAQs

Q1. Who can submit Form 15G?

Individuals below 60 years of age and Hindu Undivided Families (HUFs) whose income is below the taxable limit can submit Form 15G.

Q2. Can I download Form 15G in Word format online?

Yes, you can easily download Form 15G in Word format from official bank websites or the Income Tax Department website.

Q3. Is Form 15G mandatory to avoid TDS?

Yes, submitting Form 15G is necessary to avoid TDS on interest income for eligible individuals.

Q4. Can I submit Form 15G multiple times in a financial year?

Yes, you may submit Form 15G multiple times, especially if you have interest income from different sources.

Q5. What happens if I provide incorrect information in Form 15G?

Providing incorrect information can lead to penalties or TDS being deducted despite the form submission. Always ensure accuracy.

Q6. Is the Word format of Form 15G editable?

Yes, the Word format is fully editable, which makes filling and saving your details much easier.

Q7. Can senior citizens use Form 15G?

No, senior citizens above 60 years must use Form 15H instead of Form 15G.

Q8. Can I submit Form 15G online?

Some banks allow online submission, but generally, the filled Word form is printed and submitted in person.

Visit classicstylemag for more informative blogs.